NEL gets order for 120MW of electrolyser equipment

15 March 2023

Critical Raw Materials Act to unlock green revolution

16 March 2023The European hydrogen industry faces a massive challenge to deliver its 2030 climate and energy goals. This is particularly relevant because the bottlenecks to reach those ambitions are multifaceted: while contributing to the REPowerEU and Fit-for-55 targets, Europe must also face fierce international competition, which lately has undermined European competitiveness and attractiveness, with initiatives such as the US Inflation Reduction Act (IRA). A wake-up call for Europe was needed, especially to step-up its hydrogen ambitions.

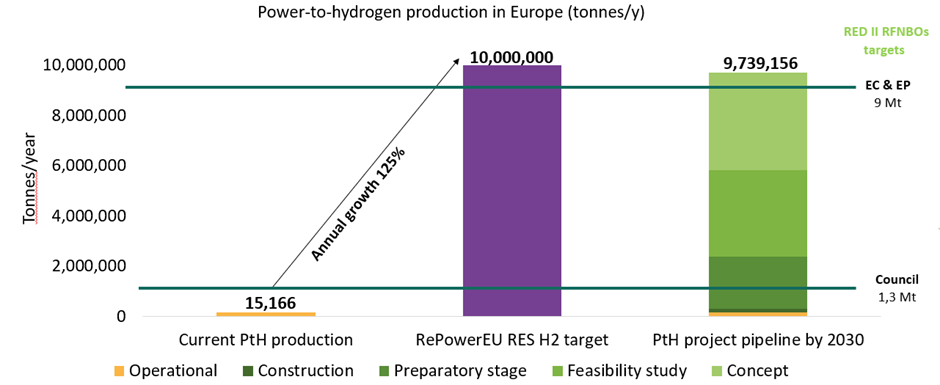

The following chart illustrates the magnitude of the challenge posed by EU ambitions to reach REPowerEU targets of domestically produced renewable hydrogen by 2030. An annual growth rate of 125% would then be required to escalate the 15,166 tons produced in 2022 to reach the 10M tons in 2030, but how can we do so when a large proportion of projects in the pipeline are still in the concept phase (7.5 M tons out of the envisaged 9.7 M tons)? In addition, there is still a sizeable cost gap between many of the applications for renewable and low carbon hydrogen. A strong market and industrial policy, supported with a fit for purpose state-aid, is therefore key to unlock the investments required at scale.

Chart 1 – Scale of the hydrogen challenge (source Hydrogen Europe)

Against this background the Green Deal Industrial Plan (GDIP)[1], adopted on the 1st of February, recognises access to finance as one of the key enablers to strengthen and increase the European manufacturing capacity and the deployment of strategic clean tech technologies, including hydrogen.

In this context, two pillar initiatives aimed at speeding up the mobilisation of state aid were announced last week:

• the Temporary Crisis and Transition Framework (TCTF), which presents an advanced revision of the state aid temporary crisis framework that was already amended to respond to the impacts of the war in Ukraine,

• the new Green Deal Global Block Exemption Regulation (GBER)1, a piece of legislation that establishes the thresholds and conditions under which aid is exempted from prior notification to the European Commission.

Both measures were published on 9th of March, marking a milestone for the support of the competitiveness and climate ambitions of the European Union, especially related to the hydrogen sector. The documents provide effective and simplified leverage for Member States to unlock the investments required at scale (including with the Recovery and Resilience Facility), and develop their economic and employment potential, with a focus on the hydrogen technologies and applications.

The Temporary Crisis and Transition Framework (TCTF)

The TCTF allows Member states to temporarily provide support schemes or individual aid2, until end 2025, for the production and storage of renewable hydrogen and renewable hydrogen-derived fuels, and the use of renewable and electricity-based hydrogen for decarbonisation of industry. Compared to the previous temporary framework, certain categories can benefit from more flexible criteria, increased aid scale and scope, and extended completion periods. The TCTF also apply to projects through a retroactive clause: projects that started before the entry into force of the TCTF can also be addressed.

The TCTF also opens, in line with the need to support European competitive edge of clean techs, the possibility to directly support investments for the scale up of the manufacturing of technologies and the related advanced materials, components and Critical Raw Materials (CRMs). By expressly addressing electrolysers, it should help trigger the manufacturing capacities needed by 2030. Beyond the schemes that Member States can adopt, enhanced support is also possible for companies that risk diverting investments to third countries through the so called “matching aid”. This support can be provided until December 2025.

Finally, the TCTF maintains the possibility for Member states to link the granting of aid to compensate for high energy electricity and gas prices (in force until end 2023), to environmental protection or security of supply requirements such as the consumption of a certain share of renewable energy, investments in energy efficiency in production processes, heating or transportation, and reduction or certification of natural gas consumption.

The Green Deal General Block Exemption Regulation (GBER)

Concerning the new GBER, the Commission presents a powerful tool that will facilitate state aid support to companies, without recurring to burdensome notification procedures. This instrument is also expected to have a positive impact on the deployment of hydrogen as it covers the whole hydrogen value chain, such as renewable hydrogen production, infrastructure (for renewable hydrogen or more than 50% of renewable hydrogen/gases), industry decarbonisation (including the use of renewable hydrogen, renewable hydrogen derivatives and low-carbon hydrogen) and the deployment of vehicle fleets and hydrogen refuelling stations (HRS, using renewable and low-carbon hydrogen).

The aid for these categories provides high notification thresholds (e.g., on renewable hydrogen production, industry decarbonisation and hydrogen mobility, and also on training and skilling of employees), and may grant up to 100% of the funding gap in case of bidding processes. The new GBER also opens for the possibility to exempt operating aid for the production of renewable hydrogen, even if this is limited to small scale installations.

The new Regulation has been designed to complement major European hydrogen support schemes to projects, such as the Important Projects of Common European Interest (IPCEIs). GBER may act as a makeshift solution where cumbersome notification procedure in Member States can undermine the granting process, causing delays for receiving funding support.

If both TCTF and GBER are aiming to kick-off hydrogen technologies and deployment in Europe, there is still some margin of improvement to align them with the EU hydrogen ambitions. In this respect, a better coverage of relevant hydrogen technologies under the TCTF and of manufacturing activities under the GBER, the support to hydrogen for power generation and a broadened scope of operating aid in the production and use of hydrogen, would deserve further assessment by the Commission, enabling a timely and fully-fledged net-zero European value chain.

In this context, Member States expressed some reluctance prior the adoption of the renewed state aid framework. For mitigating the effect of a possible uneven playing field between the different economies when it comes to public support for industry, the Green Deal Industrial Plan foresees the adoption of a European Sovereignty Fund. The Fund, which will provide a complementary funding mechanism from which all Member States can benefit equally, responding thereby to Member States’ concerns could provide additional financial firepower at the EU level to ensure strategic investments into projects of interest for EU sovereignty across the entire industrial spectrum. A first proposal should come in the medium term, as part of the mid-term review of the EU’s Multiannual Financial Framework 2021-2027, which is expected for next year.