Hydrogen Europe examines the 2023 NECP draft updates

By April 2024, 26 Member States handed in their updated draft National Energy and Climate Plans (all except Austria). The drafts give a signal as to the ambition and preparedness of the Member States in their approach to decarbonisation, energy efficiency and implementation of EU climate and energy goals. Although the EU’s legislative timeline made it difficult, it is welcome that several Member States integrated at least partial references to revised and new targets on sectoral GHG emission reduction, renewable energy uptake or energy efficiency. Still, key obligations of the revised Renewable Energy Directive (RED III), such as RFNBO consumption targets in industry and transport sectors are tackled to an insufficient extent.

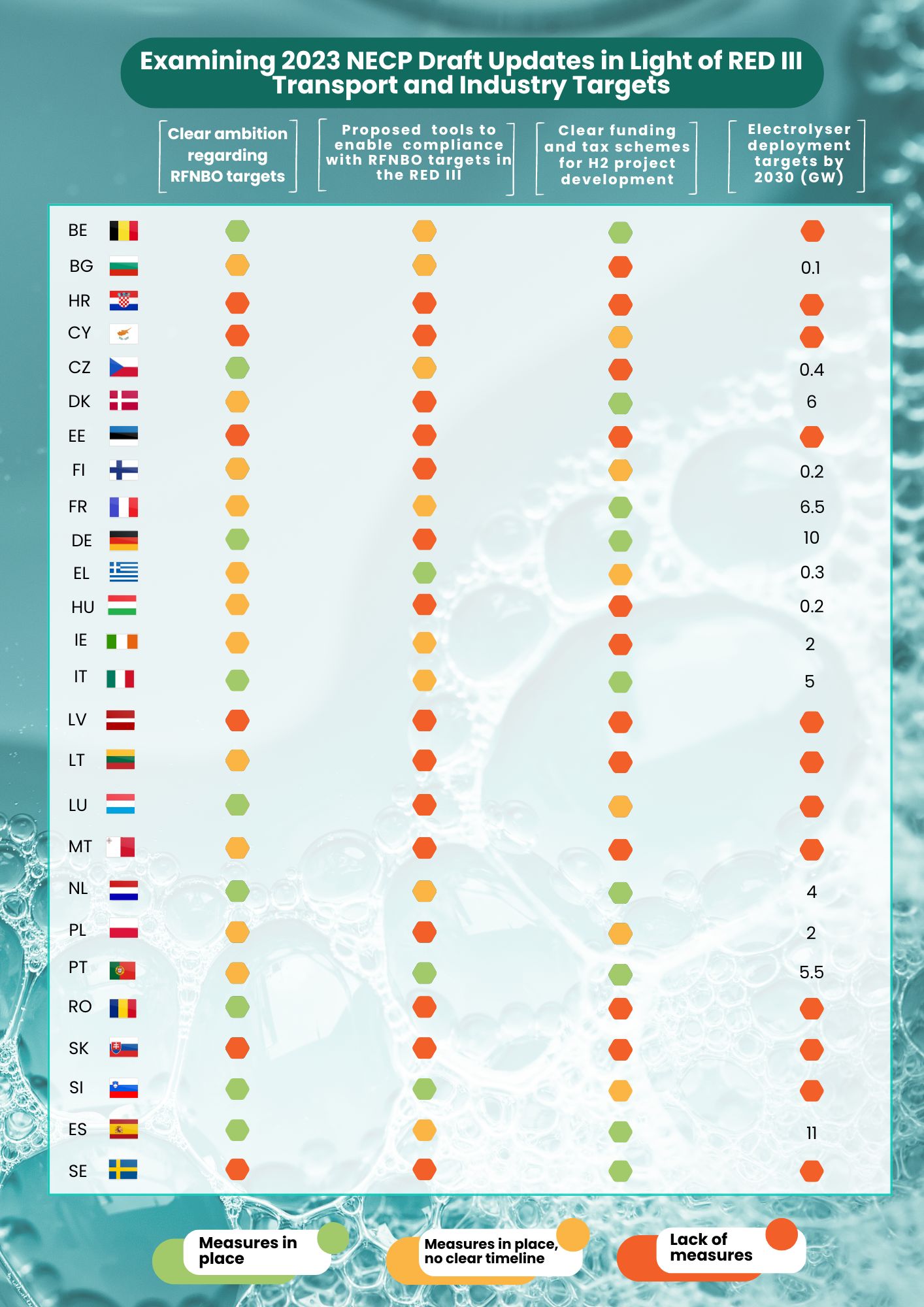

In general, the draft NECPs are of varying quality, as the Commission had suggested in its assessment in December 2023. Although the rapidly changing legislative framework on the EU level made it difficult, certain considerations should have been integrated by the Member States. The table below gives an overview of the measures mentioned in the 26 draft NECPs, regarding their approach to tackling the updated RFNBO industry and transport targets, including reference to commitments on electrolyser deployment.

The majority of the draft NECPs (20) include reference to the RFNBO targets, either to the outdated RED II transport target, or to the revised RED III industry and transport targets. Beyond existing tools to comply with the RFNBO target in the transport sector, (e.g. mandatory consumption quotas), it is essential that these are updated and revised. Member State also need to implement measures to comply with the new industry target of RFNBO consumption. It is concerning that out of the 20 NECPs that include reference to RFNBO targets, 13 do not have targets referring to industrial consumption. Member States need to update their calculation method on transport and industry targets, explicitly referencing RFNBO consumption.

Only 11 draft NECPs have somewhat well outlined, elaborated proposals for national policy/legal tools enabling compliance with the new RFNBO industry and transport targets.

These include guarantees of origin (GO) or certification systems for renewable hydrogen, specific purchase obligations, dedicated databases to simplify accounting, and centralised purchasing systems. Well defined policy measures to enable Member State and business-level compliance with the RED targets are quintessential in the definitive version of the revised NECPs.

A detailed review of investment needs is lacking in almost all drafts. Only 15 draft NECPs include plans to establish clear financing and funding schemes, including tax arrangements to support and promote hydrogen project developments. Concentrating on these investment holes are crucial to attract private investment into novel industrial sectors.

It is welcome that 14 NECPs include reference to their national electrolyser deployment targets, totalling 53 GW of electrolyser capacity by 2030 (equating to 9 million tonnes/year renewable H2 production). Nevertheless, national electrolyser deployment targets are a major factor in Member State decarbonisation and should therefore be included in all revised NECPs. Beyond the electrolyser targets, description of measures, programmes and legislative activity regarding industrial hydrogen development should be provided by all Member States.

- The draft describes a new scheme in place that requires suppliers of liquid and gaseous fuels to provide a minimum proportion of renewable fuels on an annual basis, compared to the total amount of fuels placed on the market. However, concrete implementation measures on the revised RED are yet to be described.

- The draft mentions a registry that will be put in place to enable the accounting of renewable energy units for the transport sector, allowing a shift from fossil fuels to renewable electricity and molecules.

- There are investment schemes in place that provide for R&D and scaling of hydrogen technologies, including on the Hydrogen backbone, while the draft introduces further dedicated grants and calls in the field.

- The plan does not include an indicative target for electrolyser deployment by 2030.

- The draft plan refers to the development of a blending system enabling up to 10% hydrogen in the national system. This also accelerates the development of a new guarantee of origin scheme for hydrogen and advanced biogas.

- The draft includes a target of up to 100MW of Electrolysis by 2030

- The draft describes that the minimum market uptake of RFNBOs in the transport sector will be defined, linking it to the Alternative Fuel Infrastructure Regulation (AFIR).

- The draft does not include specific measures on implementing the RED3.

- The draft introduces plans to develop a certification system regarding the origin of renewables, renewable hydrogen and of advanced biofuels.

- There is no indicative target on electrolysers deployment

- According to the draft, current projections show that the 1% RFNBO transport target would not be met, as only 0.05% contribution is foreseen. Nevertheless, this does not yet consider shipping RFNBO use, to be calculated later.

- There are plans towards the establishment of mandatory biofuels blending obligations on transport fuels, which could be translated into RFNBO blending. The draft also proposes lower duty rates on alternative fuels and higher rates on fossil-based fuels, as it is encouraged in the ETD revision.

- The draft includes plans on support schemes for renewable hydrogen production.

- The draft does not include an indicated target on electrolyser deployment.

- The draft proposes the revision of domestic legislation to allow for RED renewables commitments in transport not only directly, but also exploiting the potential of renewable energy sources from other fuel suppliers by pooling them in a similar way as national legislation already allows for emissions savings.

- Although the revised RED targets are considered in the draft, little development is visible regarding implementation rules.

- The draft includes an indicative target of 400MW electrolysis by 2030

- The draft includes targets for advanced biofuel use. However, RFNBO sub-targets are not proposed, as the draft first needs clarification on the interplay amongst the different Fit for 55 legislations and their targets on RFNBO consumption.

- The draft describes dedicated funding (including Just Transition Fund) and investment aid towards hydrogen development.

- The draft includes a reference to the 6GW electrolyser target that is part of the national Hydrogen Strategy

- The draft mentions initial analyses on possible hydrogen blending solutions, but renewable fuel targets and measures are not described.

- The draft does not include an electrolyser deployment target.

- The draft NECP mentions plans for a road transport biofuel share target of 34% by 2030, including an RFNBO sub-quota of 2% (2021-2023), 4% by 2025 and 10% by 2030. Nevertheless, the caveat is mentioned that these are the figures of the old government, while review of these RFNBO sub-targets are necessary by the new government.

- The draft emphasises that the entry into force of the revised RED necessitates the review of national efforts in renewable deployment.

- The draft proposes new investment dedicated to hydrogen pipeline and further infrastructure (including under the RRF).

- The draft includes an electrolyser deployment target of 200MW by 2030.

- The plan proposes a 15% renewable gas injection (blending) target by 2030.

- The draft mentions that the tax incentives towards the use of renewable fuels and energy in transport is extended, while another tax scheme is planned to be deployed for sustainable fertiliser (including ammonia) purchases.

- The draft also introduces both CAPEX and OPEX support mechanisms for clean energy technologies, including for hydrogen.

- The draft includes an electrolyer deployment target of 6.5GW by 2030.

- The draft proposes the reviewing of Germany’s electrolysis deployment and RFNBO production ambition in view of the raised ambition of sub-targets in the revised RED.

- The German ‘Climate Change Contracts’ funding programme helps industrial companies to invest in and operate climate-friendly production facilities that would otherwise not be expected. In addition, the support programme ‘Decarbonisation in industry’ allows the federal government to support energy-intensive industry (e.g. steel, chemicals, cement) in developing and investing in innovative climate protection technologies (including hydrogen) to avoid process-related greenhouse gas emissions.

- The plan includes an indicative electrolysis deployment target of 10GW by 2030.

- The draft introduces blending quotas on the supplier for fuels on the wholesale market, drawing parallels with the current biofuel blending rules to be possibly transposed into RFNBO rules. The draft mentions an RFNBO transport fuel target of 1% by 2030 connected to a 2.4% advanced biofuels transport consumption target by 2030.

- The draft proposes the development of a certification system for renewable hydrogen and synthetic fuels. The plan also refers to Law 5037/2023 on the RED II transposition, which already includes certain definitions about green hydrogen.

- To alleviate price pressure, the draft proposes subsidies and tax relief in the RFNBO market.

- The draft includes an electrolyser deployment target of 300MW by 2030.

- The draft proposes a minimum of 5% advanced biofuels in the final transport consumption in the country by 2030, including a sub-target of RFNBO 1% RFNBO in transport.

- In addition, to reach the renewables sectoral targets in the revised RED, the draft also includes plans to significantly raise electricity and hydrogen use in transport by 2030 (including through buses).

- The plan includes a 200MW electrolyser deployment target by 2030.

- The draft proposes increasing the proportion of renewable transport fuels in road transport through obligations, in connection with a fossil fuel car ban by 2030. Further, the plan describes the development of a regulatory and market regime to enable the injection of renewable gases in the grid.

- The draft also mentions that 2 GW offshore wind capacity by 2030 is earmarked for renewable hydrogen production and other non-grid uses.

- The plan includes a 2GW electrolysis target by 2030.

- The draft also plans to exceed the 5.5% advanced biofuels target of the revised RED, including its 1% RFNBO sub-target. This is done by updating the national incentive mechanisms provided for advanced biofuels until a target of 10% is reached. This also means the doubling of the RED III target in transport, including a final national RFNBO transport sub-target of 2%.

- The draft mentions that the guarantees of origin system is also being updated to accommodate novel solutions, such as hydrogen.

- The plan describes financing measures in place, such as climate tagging of financial resources, including towards hydrogen development projects and for the deployment of the hydrogen backbone. In addition, the plan refers to hydrogen as one of the priority areas in R&D funding.

- The plan includes a 5GW electrolysis deployment target by 2030.

- The plan proposes the development of tax schemes favouring low-emission transport fuels, nevertheless, with not sufficient clarity.

- The plan does not have an electrolysis deployment target.

- The draft also includes plans to set obligations on fuel suppliers to provide advanced biofuels and RFNBOs. This also includes a target of 3.5% advanced biofuel or RFNBO sub-target by 2030. The overall share of biogas and RFNBO in the final transport energy consumption is aimed at 5.2% by 2030.

- The plan includes an ambition of accelerating hydrogen use in transport, by aiming for 5% of cars running on hydrogen (including fuel cell and combustion technologies) by 2030.

- The plan does not have a 2030 electrolysis deployment target.

- The draft includes a target of replacing 100% of fossil-based hydrogen used in the industry to renewable hydrogen by 2030, which would satisfy the corresponding RFNBO industry target.

- The draft plan provides a measure that first generation biofuels are limited to 5% in the transport fuel mix in order to promote second generation biofuels and RFNBOs.

- The plan also introduces intra-EU cooperation on accelerating RFNBO production deployment.

- The plan does not have an electrolysis deployment target.

- The plan mentions that the drafters are in process of assessing the obligations under the revised RED.

- The plan describes the current obligations on biofuel blending of 14% by 2030, and the obligation to increase the share of advanced biofuels to 3.5% by 2030. These schemes can in principle be transformed to accommodate and incentivise RFNBO targets.

- The plan does not have an electrolysis deployment target.

- The draft refers to renewable (bio and synthetic) fuel targets of 14% by 2030, and 100% by 2050. In addition, the draft explores the possibilities for purchase obligations for renewable hydrogen in the industry – a scheme schedules for 2026.

- The draft mentions ongoing work on the development of hydrogen certification and standardisation, including on safety standards.

- The plan also describes strengthened grant instruments, accommodating hydrogen projects, in addition to a mix of financing instruments in the works, aimed to scaling up hydrogen deployment.

- The draft indicates an electrolyser deployment target of 4GW by 2030.

- The draft proposes introducing a national sub-target of 1% advanced biofuels, biogas and RFNBO in the transport sector by 2025, raising it to 3.5% by 2030.

- The plan also introduces RNFBO production capacities, connecting it with CfD financing schemes for hydrogen production.

- The draft includes an electrolyser deployment target of 2GW by 2030.

- The draft mentions an extensive industrial policy to be developed for a renewable gas production cluster, in particular for hydrogen.

- The draft refers to Regulation n 15/2023 establishing the centralised purchasing system for biomethane and hydrogen. Further, the implementation of systems of guarantees of origin and certification is planned for renewable gases.

- The draft refers to existing funding programmes for renewable gas production (including hydrogen), launched in 2019 and subsequently in 2021, 2023.

- The draft includes an electrolyser deployment target of 5.5GW by 2030.

- The draft refers to Romania’s Hydrogen Law, which provides that fuel suppliers must ensure until 2030 that the energy value from the amount of RFNBO supplied to the market in Romania and used in the transport sector in one year is at least equal to 5% of the energy content of all fuels supplied for consumption or market use in Romania.

- The plan does not have an electrolysis deployment target.

- The plan expresses that the drafters are in process of assessing the obligations under the revised RED. Nevertheless, sufficient clarity is missing.

- The plan does not have an electrolysis deployment target.

- The draft mentions the target of having at least 10% gaseous renewable fuels in the total gas supply by 2030 (this includes hydrogen, biomethane and other renewable gases).

- The draft refers to the development of financial incentive schemes for the decarbonisation of hard to abate sectors, including through hydrogen deployment (including through domestic and EU funds). In addition, the plan describes that R&D into renewable hydrogen will be further promoted.

- The plan does not have an electrolysis deployment target.

- The draft also mentions that the achievement of the RED sub-targets will be done by reducing consumption and by deploying RFNBOs. This will take form in promoting RFNBOs in transport, and updating the certification system, introducing consumption obligations on advanced biofuels, RFNBOs and blends. Also, the plan describes establishing annual targets for the integration of renewable energy in air transport and the supply of alternative fuels, and special targets for consuming advanced biofuels and RFNBOs (SAFs).

- The draft also describes the introduction of an e-credit mechanism that recognises electricity and other energy alternatives for supplying vehicles, according to the new RED framework. The current SICBIOS system is not compatible with novel renewable fuels, such as hydrogen, as there is no accounting mechanism included therein.

- The plan describes the continuation of existing and the development of new support schemes, including on hydrogen (through the RRF and the Strategic Projects for Economic Recovery and Transformation - PERTE). In addition, comprehensive aid structures for industrial decarbonisation are being put in place, which would include hydrogen technologies.

- The draft includes an electrolyser deployment target of 11GW by 2030.

- The draft describes the obligation to supply renewable fuels in service stations of a certain size, thereby laying the groundwork for RFNBO consumption in the mobility sector. Nevertheless, necessary clarity is missing.

- Under the Nordic Cooperation, funding schemes are dedicated towards hydrogen, ammonia and e-fuels deployment. The draft plans to develop further aid schemes for hydrogen refuelling infrastructure deployment.

- The plan does not have an electrolysis deployment target.